IRS 8949 Instructions 2024-2026 free printable template

Show details

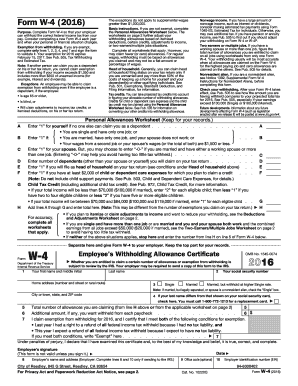

If you are attaching multiple Forms 8949 to your return attach the Form s 8949 that lists code Z in column f first. Complete Form 8949 before you complete lines 1b 2 3 8b 9 or 10 of Schedule D. Purpose of Form Use Form 8949 to report sales and exchanges of capital assets. If you e-file your return but choose not to report each transaction on a separate row on the electronic return you must attach Form 8949 to Form 8453 or the appropriate form in the Form 8453 series and mail the forms to the...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign pdffiller form

Edit your form 8949 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8949 instructions pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 8949 instructions online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 8949 instructions 2024. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8949 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out instructions for form 8949

How to fill out IRS 8949 Instructions

01

Obtain IRS Form 8949 from the IRS website or tax software.

02

Identify the type of transactions you need to report (short-term or long-term).

03

List each transaction on the appropriate section of Form 8949, including details such as description of the property, date acquired, date sold, sales price, cost or other basis, and gain or loss.

04

Make sure to include any adjustments to gain or loss in the appropriate column.

05

Calculate total gains and losses for both short-term and long-term transactions.

06

Transfer totals from Form 8949 to Schedule D, which is used for summarizing capital gains and losses.

07

Review for accuracy and completeness before filing with your tax return.

Who needs IRS 8949 Instructions?

01

Taxpayers who have sold capital assets such as stocks, bonds, or real estate.

02

Individuals who have capital gains or losses to report during the tax year.

03

Anyone who has received a Form 1099-B from a broker detailing their sales of securities.

Fill

irs form 8949

: Try Risk Free

People Also Ask about instructions form 8949 for

Do I need to list every stock transaction on form 8949?

Regarding reporting trades on Form 1099 and Schedule D, you must report each trade separately by either: Including each trade on Form 8949, which transfers to Schedule D. Combining the trades for each short-term or long-term category on your Schedule D. Include a separate attached spreadsheet showing each trade.

Do I need to report 8949 form?

Individuals use Form 8949 to report the following. The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not used in your trade or business. Nonbusiness bad debts.

How do I know if I need to file form 8949?

Anyone who has received one or more Forms 1099-B, Forms 1099-S, or IRS-allowed substitutions should file a Form 8949. You may not need to file Form 8949 if the basis for all of your transactions was reported to the IRS, and if you don't need to make any adjustments to those figures.

Who must file form 8949?

Anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete Form 8949. Both short-term and long-term transactions must be documented on the form.

What transactions are not reported on form 8949?

Taxpayers can omit transactions from Form 8949 if: They received a Form 1099-B that shows that the cost basis was reported to the IRS, and. You did not have a non-deductible wash sale loss or adjustments to the basis, gain or loss, or to the type of gain or loss (short term or long term).

Do I have to report every stock transaction 1099-B?

Even though the stock was sold in a single transaction, you must report the sale of the covered securities on two separate 2023 Forms 1099-B (one for the securities bought in April 2022 with long-term gain or loss and one for the securities bought in August 2022 with short-term gain or loss).

Do you have to file a 8949 and Schedule D?

Any year that you have to report a capital asset transaction, you'll need to prepare Form 8949 before filling out Schedule D unless an exception applies. Form 8949 requires the details of each capital asset transaction.

Do I have to report every stock transaction on form 8949?

What you may not realize, is that you'll need to report every transaction on an IRS Form 8949 in addition to a Schedule D. And if you sold stocks for less than you paid for them , you need to report those losses too.

In what circumstance would form 8949 not have to be filed?

Taxpayers can omit transactions from Form 8949 if: They received a Form 1099-B that shows that the cost basis was reported to the IRS, and. You did not have a non-deductible wash sale loss or adjustments to the basis, gain or loss, or to the type of gain or loss (short term or long term).

Do I need to send 8949?

You don't need to manually fill out Form 8949, because we automatically do that when you enter your investment sales or exchanges. If you're paper-filing your return, Form 8949 will simply be included with all your other tax forms when you print them out.

Do I have to list all stock transactions on my tax return?

In general, individual traders and investors who file Form 1040 tax returns are required to provide a detailed list of each and every trade closed in the current tax year.

Do I need to submit form 8949?

If you e-file your return but choose not to report each transaction on a separate row on the electronic return, you must either (a) include Form 8949 as a PDF attachment to your return, or (b) attach Form 8949 to Form 8453 (or the appropriate form in the Form 8453 series) and mail the forms to the IRS.

Is Schedule D the same as form 8949?

Schedule D of Form 1040 is used to report most capital gain (or loss) transactions. But before you can enter your net gain or loss on Schedule D, you have to complete Form 8949.

Do I have to include Schedule D on my tax return?

Schedule D is required when a taxpayer reports capital gains or losses from investments or the result of a business venture or partnership. The calculations from Schedule D are combined with individual tax return form 1040, where it will affect the adjusted gross income amount.

When can I skip form 8949?

Taxpayers can omit transactions from Form 8949 if: They received a Form 1099-B that shows that the cost basis was reported to the IRS, and. You did not have a non-deductible wash sale loss or adjustments to the basis, gain or loss, or to the type of gain or loss (short term or long term).

Do I have to report every stock transaction on form 8949?

Enter all sales and exchanges of capital assets, including stocks, bonds, and real estate (if not reported on line 1a or 8a of Schedule D or on Form 4684, 4797, 6252, 6781, or 8824). Include these transactions even if you didn't receive a Form 1099-B or 1099-S (or substitute statement) for the transaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 8949 instructions pdf?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific 8949 instructions and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit form 8949 instructions 2024 pdf in Chrome?

form 8949 and schedule d can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my form 8949 instructions in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your 8949 tax form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is IRS 8949 Instructions?

IRS 8949 Instructions provide guidelines for taxpayers on how to report capital gains and losses from sales and exchanges of capital assets.

Who is required to file IRS 8949 Instructions?

Taxpayers who have sold or exchanged capital assets such as stocks, bonds, or real estate are required to file IRS 8949 Instructions.

How to fill out IRS 8949 Instructions?

To fill out IRS 8949 Instructions, you need to list each transaction, including description of the asset, dates acquired and sold, sales price, cost basis, and gain or loss.

What is the purpose of IRS 8949 Instructions?

The purpose of IRS 8949 Instructions is to ensure accurate reporting of capital gains and losses, which helps in calculating the correct tax liability.

What information must be reported on IRS 8949 Instructions?

Information that must be reported includes the description of the asset, date acquired, date sold, sales price, cost basis, and the gain or loss for each transaction.

Fill out your IRS 8949 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8949 Instructions is not the form you're looking for?Search for another form here.

Keywords relevant to federal tax form 8949

Related to 8949 instructions 2024

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.